City manager won’t recommend property tax hike after botched poll

The consultant used a significantly lower dollar amount than would be needed to raise the desired funds. Despite that, the tax still polled abysmally.

As the city of Long Beach faces tens of millions of dollars in budgetary shortfalls in the coming years, officials have been exploring all avenues to increase city revenues. One of the latest efforts was a property tax increase survey to see what voters thought.

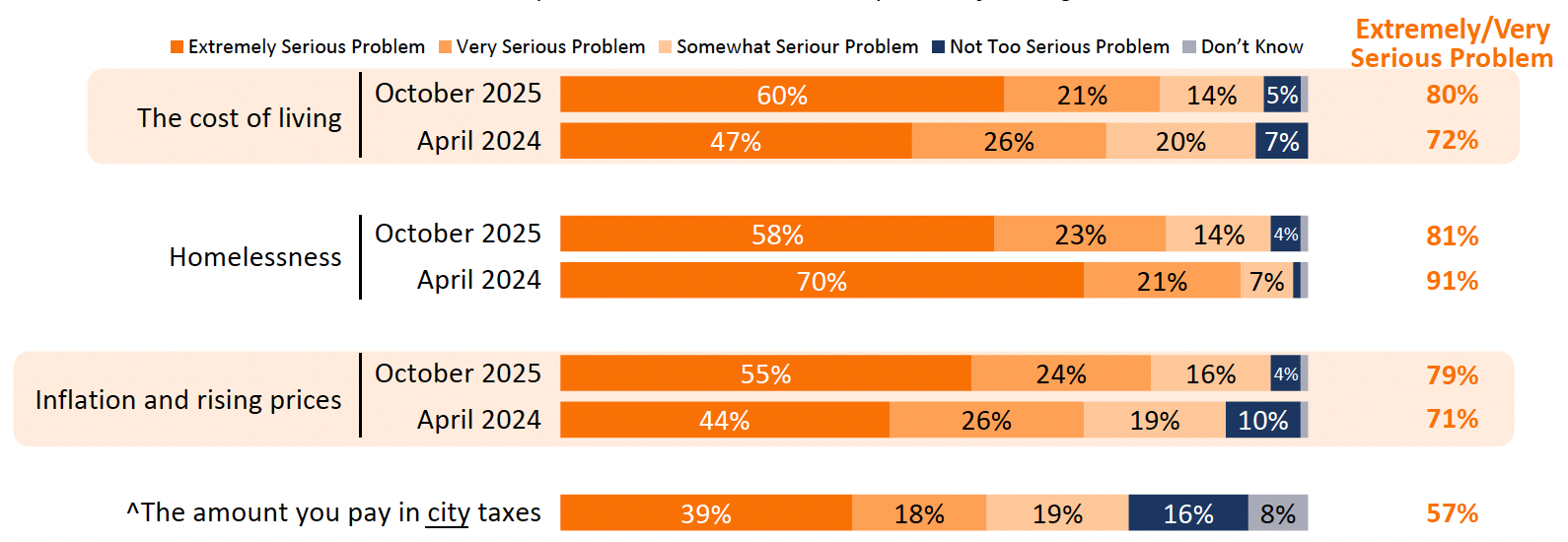

Unsurprising, given the financial hardships faced by many as the price of goods remains high and health insurance premiums skyrocket, respondents to the poll offered a resounding “no thanks.”

Sent to residents in October, the proposed ballot initiative was dubbed the “Long Beach 911 response, neighborhood safety, clean water/infrastructure repair measure.” The ordinance looked to generate $200 million annually with an 8 cent fee per square foot of parcels of land on all property types.

The revenue would then be used to pay for a host of services and improvements, including “improving/maintaining firefighter/paramedic/police services; preventing healthcare cuts; protecting clean water; repairing sidewalks/streets; improving libraries/parks; building affordable housing/addressing homelessness, and maintaining general City services,” according to a report by consultant firm FM3 Research.

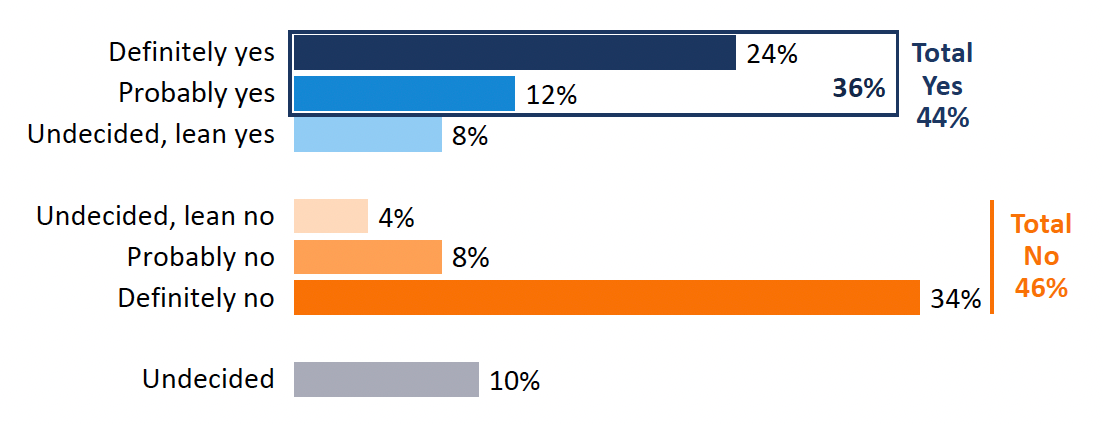

The results were clear, however, with 46% of respondents saying they would vote against the measure and 44% saying they would vote yes.

While the figures appear close, the reality is that ballot measures to increase property tax assessments require a 66% supermajority of voters to approve, City Manager Tom Modica, whose office put out the poll, explained.

“That’s a high bar to hit,” Modica said in a December interview with the Watchdog, adding that the city has tested the idea of increased property taxes over the last several years. Similar tax increases on behalf of school districts only require 55% of the vote.

“But it’s really hard to get to 66% and, of course, this is a much different economy,” he said.

Respondents to the poll agreed that the economy is an issue, with 80% feeling that cost of living is a serious problem, up from 72% in April 2024. Similarly, 79% said inflation is a serious concern, up from 71%.

“We understand that there are concerns out there,” Modica said. “We also want to be responsive to our residents who say we need [better] roads, we need more police and fire, we need more coastal infrastructure, we need affordable housing, we need homelessness [funding].

“At this point, I’m not going to be recommending anything that the council brings forward,” Modica added, noting that there may be “difficult times” to come if the city cannot shore up its revenue streams.

Aside from the abysmal polling numbers, the survey was also flawed. Modica said that a tax consultant had an error in its calculations ahead of the poll. The city, in turn, provided FM3 with incorrect data. The actual dollar amount per acre would have needed to be $1,313 per acre, nearly $1,000 higher than the figure tested in the poll, according to Modica.

“The consultant has recognized the error and refunded the entire amount of the tax research to the city,” Modica said.

Despite claims in some local reports, the city has only sent out one poll related to property tax increases this year, according to Modica. Any other polls received by residents were sent by groups not affiliated with the city, he said.

Critics of the now-failed property tax increase proposal were quick to point out that the funding would go toward some areas already funded by Measure A, a previous tax increase.

The Measure A sales tax increase was initially passed by voters in 2016 as a temporary revenue generator to stop cuts to public safety as well as fund infrastructure projects around the city. It was made permanent by voters in 2020.

Despite the tax increase, the number of vacancies in the Long Beach Police Department has ballooned, response times are up and the amount of overtime has skyrocketed. A large amount of funding has gone to pay salaries, including mass amounts of overtime.

In 2024, 102 officers earned more than $100,000 in overtime pay, according to Transparent California. Five officers earned more than $200,000.

Modica noted that the city went several years without any new officers due the academy training force being cut. But the city recently celebrated the opening of a $33 million permanent academy facility capable of hosting academy classes of up to 100 recruits. Nearly 80% of the funding came from Measure A.

Measure A has been a boon for infrastructure. To date, the tax has supported 51 park playground, community center and facility projects, more than 572 lane miles of street repairs, nearly 2 million square feet of sidewalk replacement, 29 public facility projects and more, according to the city’s website.

But residents continuously decry Long Beach’s streets, saying they remain in dire need of repair.

Streets receive grades on the Pavement Condition Index ranging from 0 to 100. An Aug. 1 memo from the Public Works Department boasted that the city’s Pavement Condition Index improved from an average of 56 in 2023 to 61. About 46% of the city’s streets, however, have a very poor, poor, marginal or fair rating.

“Measure A is very restricted — it’s public safety and infrastructure only,” Modica said, noting that other areas are in need of additional funding, including homelessness, affordable housing, business programs and a safety net against shakeups in the national economy.

“We all knew going into Measure A that it was not going to be the one thing that funds everything in the city,” Modica said.

Since the COVID-19 pandemic, the city has been able to manage its budget using Recovery Act dollars, Modica explained, which allowed the city to avoid major reductions in services. But those funds have dried up.

“So over the past couple of years we have been looking at how do we continue to grow our revenue base?” Modica said, noting the city’s push for economic growth in certain sectors such as aerospace, transportation and logistics, entertainment, health care and education.

“I think we’re going to see less and less investment from our federal government and from the state government,” Modica said. “So it kind of leaves it up to us.”

Editor’s note: This story has been updated to clarify how the error in the poll occurred.

We need your support.

Subcribe to the Watchdog today.

The Long Beach Watchdog is owned by journalists, and paid for by readers like you. If independent, local reporting like the story you just read is important to you, support our work by becoming a subscriber.